Everyday life brings the unexpected, along with the things you plan for and look forward to. There’s no way to know what’s ahead, and details and deadlines can keep you up at night. Wichita Insurance helps provide some peace of mind, whether you’re at home or on the road.

Homeowners Coverage

Your home is the usually the biggest purchase you will make and is your most valuable asset. There will come a time you will have damage, you will need an insurance agent that will find the best company to fit your needs and settle your claims quickly. At Wichita Insurance, we will help you find the right fit for your needs with providing quality service and affordable pricing.

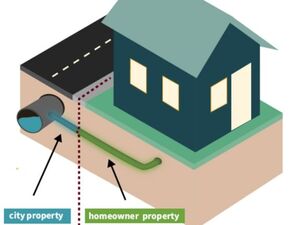

Service Line Coverage This product protects the homeowner by extending coverage for damage to underground piping, wiring, valves, or attached devices that connect a home to a public utility service provider or to a private system.

|

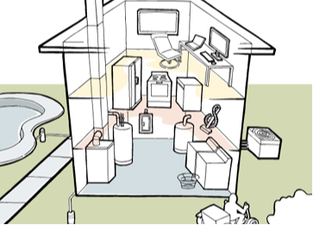

Equipment Breakdown CoverageCovers repairing or replacing essential equipment in your home with it breaks down. Covered losses include electrical, mechanical, and pressure systems breakdown.

|

Extended Replacement CostMost homeowner policy limits track inflation in building costs. Extended replacement cost policies are designed to protect the policyholder after a major disaster when the high demand for building contractors and materials can push up the normal cost of reconstruction.

|

Other Available Coverage

|

|

|

Flood Coverage

Many homeowners believe that they only need or can get flood insurance if their mortgage company or bank requires it, which is mostly when the home is located in areas categorized as “high risk” (flood zone A or V). The fact is, you don’t need to live in a high risk area to be at risk. Wherever it rains, it can flood, regardless of your proximity to a body of water.

Type your address below to get an instant flood quote

Auto Coverage

Whatever you drive, wherever you go, feel confident that you, your loved ones and your pockets are properly protected. Let us worry about the risks of the road, while you enjoy the freedom of the ride.

Liability CoverageLiability coverage includes both bodily injury and property damage liability coverage and is required in most states. Basically, if you cause an accident, hurt someone or damage someone's property, it can pay for covered damages and to defend you if a lawsuit results.

Collision CoverageCollision coverage helps pay for damage to your vehicle if your car hits another car or object, gets hit by another car or if your vehicle rolls over. This coverage is generally required if your car is financed or leased.

|

Medical Pay CoverageMedical payments coverage helps pay for covered medical expenses for anyone injured while in your vehicle, regardless of who is at fault.

Comprehensive CoverageComprehensive coverage helps pay for damage to your vehicle that is not caused by a collision. For example, theft, vandalism, hitting a deer or other animal, storms and certain natural disasters.

|

Other Available Coverage

|

|

|

RelatedProducts Offered

Renters InsuranceRenters insurance can help to cover more than your personal property. It can help to protect you from personal liability, so you can rest easy.

|

Condo InsuranceYour condo association may have insurance, but your individual unit has its own coverage needs. Condo insurance protects your personal property and liability.

|

Landlord Dwelling InsuranceProtect your property investment with insurance coverage designed for rental property owners. We can offer ACV or RC coverage on scheduled form.

|

Umbrella InsuranceHome and auto insurance policies have limits to how much will be covered. If faced with paying claims that are beyond what your insurance policy covers, an umbrella policy kicks in and provides you with additional protection.

|

Jewelry and Valuable Items CoverageFrom jewelry to collectibles, you may have more valuables than you realize. And your home insurance policy may not provide the coverage you need.

|

Watercraft InsuranceYour time out on the water should be relaxing and fun (and safe!). Be sure your watercraft and equipment is properly insured. Wichita Insurance offers customized policies that meet your needs & your budget.

|

RV InsuranceWhether you hit the road a couple times per year or spend months at a time seeing the countryside from your RV, Wichita Insurance can help find the right RV insurance policy for you.

|

Motorcycle / Off Road InsuranceIf you're shopping for insurance for your first motorcycle, you have a lot of coverage options to consider. Wichita Insurance can help you look at all the choices, and put together a motorcycle insurance policy that works for you and your budget.

|

Earthquake Insurance90% of Americans live in areas considered seismically active, but most homeowner, condo, and renters insurance policies don't cover earthquake damage. The limits of what your policy covers can be confusing, but we're here to help you decide if you should consider earthquake insurance.

|